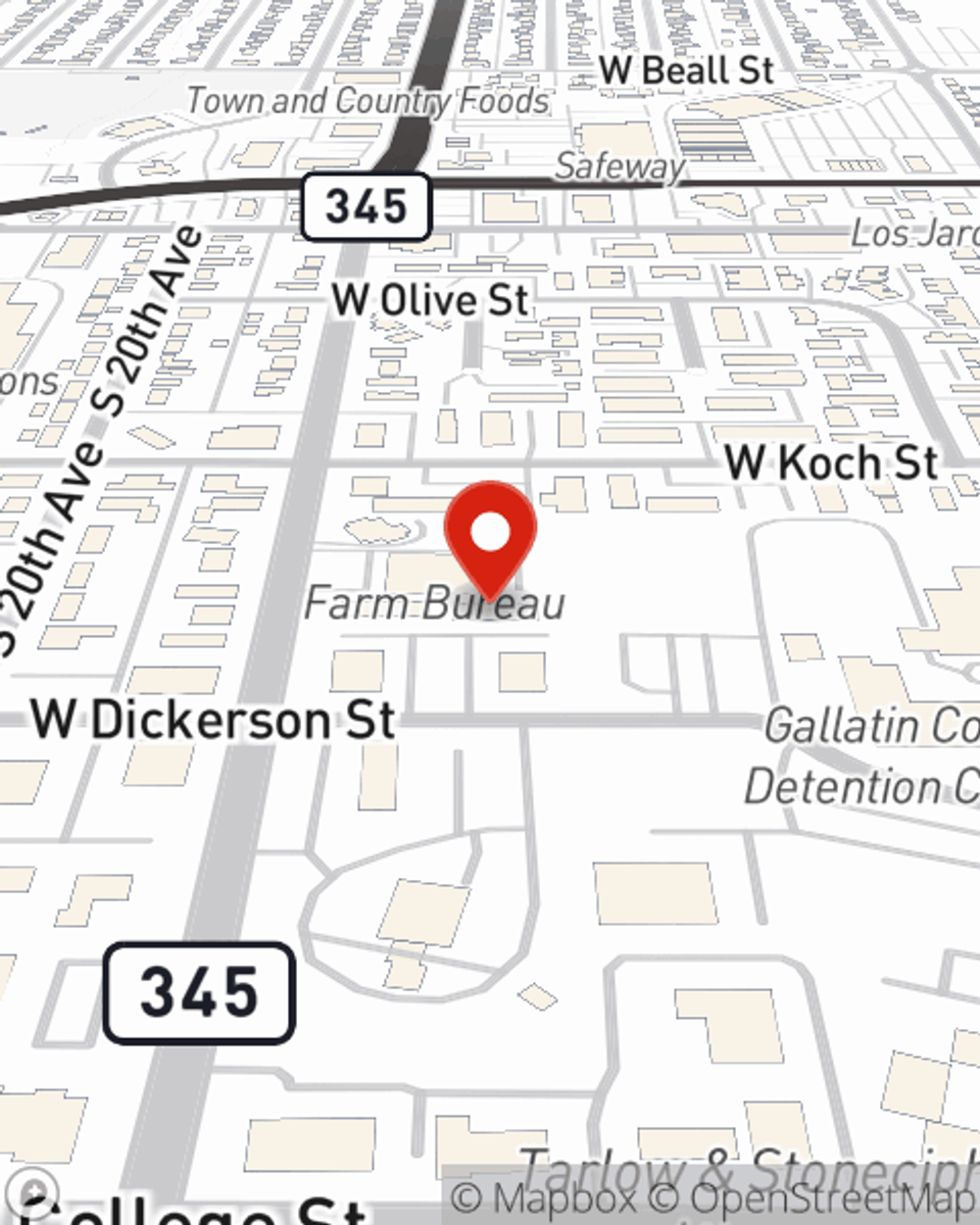

Life Insurance in and around Bozeman

Life goes on. State Farm can help cover it

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

- Bozeman

- Belgrade

- Big Sky

- Manhattan

- Three Forks

- Ennis

- Harrison

- West Yellowstone

- Townsend

- Livingston

- Whitehall

- Gallatin County

- Madison County

- Jefferson County

- Park County

Check Out Life Insurance Options With State Farm

It can be what keeps you going every day to provide for your loved ones, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that the people you love can keep paying for your home and/or pay for college as they mourn your loss.

Life goes on. State Farm can help cover it

Now is the right time to think about life insurance

Life Insurance You Can Trust

Fortunately, State Farm offers numerous coverage options that can be personalized to correspond with the needs of those most important to you and their unique situation. Agent Dan Rust has the deep commitment and service you're looking for to help you settle upon a policy which can assist your loved ones in the wake of loss.

More people choose State Farm® as their life insurance company over any other insurer. Are you ready to learn more about what a State Farm policy can do for you? Contact State Farm Agent Dan Rust today.

Have More Questions About Life Insurance?

Call Dan at (406) 587-8287 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.